3-9-2019 30 stocks hit 52-week high

30 stocks hit 52-week high; is TINA factor driving these shares?

On September 3, thirty stocks had hit fresh 52-week highs. Meanwhile, the market was witnessing one of its biggest falls in recent months, with Sensex down 800 points and Nifty wiped off nearly 200 points.

Making money in equity markets is not easy and it gets doubly difficult when there is a fear of recession. India’s growth is at a six-year low and it sent the Sensex and the Nifty hurtling below crucial support levels on September 3.

But, some stocks, including HDFC AMC, Asian Paints, Apollo Hosp and Dr Lal Pathlab, have braved the gloom to consistently hit fresh 52-week highs.

On September 3, too, more than 30 companies hit new highs on the BSE, when the Sensex was down nearly 800 points and Nifty more than 200. Abbott India, Bata India, HDFC AMC, ICICI Lombard, InterGlobe Aviation, Infosys, Petronet LNG and TCS were among the stocks that did well.

So, should one invest in these stocks? Or is the TINA (there is no alternative) factor playing out in favour of some of the stocks? Does it make sense to play the momentum?

The answer lies in appetite for risk, says experts. The fact that most of these stocks have been rallying for some time, the risk-to-reward ratio might not be that attractive.

“TINA along with passive strategies is one of the reasons we are seeing this concentration in the market. So yes, there is a TINA effect since even if there is a stock that is attractive as per valuations in small or midcap with a good growth story, we are not seeing buying coming in,” Mustafa Nadeem, CEO, Epic Research, told Moneycontrol.

“Hence the smallcap and midcap are paying the prices for the same. So, momentum may continue due to TINA or FOMO but it is not necessary they may continue to lead. One has to be cautious,” he said.

But, some stocks do have a good fundamental story and investors can buy them on dips for a long-term perspective, as most of them are leaders in their segments. However, if you are invested then partial profit booking could be done on rallies.

HDFC AMC is one of the best performing life insurance companies posting better AUM for the quarter, while Bata India posted margin led growth.

Dr. Lal Pathlabs reported strong volume performance for the June quarter and is expected to post higher volume and profitability led growth in FY20.

Apollo hospitals, apart from delivering a strong quarter, has guided for debt reduction and stated that it is likely to reduce promoter pledge. Asian Paints and Berger both posted strong revenue and profits (due to lower crude oil prices).

“It wouldn’t be fair to say that TINA factor is playing in some of these stocks, as despite hovering at 52-week highs, most of the companies are leaders in their respective sectors. They have been consistent performers and have good long-term growth prospects going ahead,” Ajit Mishra, Vice President, Religare Broking, told Moneycontrol.

“Nevertheless, we would advise investors to book partial profit, as there might be some consolidation in the near-term given stretched valuations.”

Sumeet Bagadia, Executive Director, Choice Broking, gives a technical outlook on HDFC AMC, Asian Paints, Bata India, Apollo Hospitals and Dr. Lal Pathlabs, which hit a fresh 52-week high in the week gone by:

The stock has performed well in the last one year after listing. The stock is trading above its 21 and 500-days simple moving averages, which show that there is more upside.

On the weekly chart, the stock has been trading in its upward rising wedge formation and is hovering near the breakout zone.

The RSI reading is at 72.43 level and gives positive crossover, apart from this, the RSI has formed symmetrical triangle and also trading above this formation, which points out a positive breath in the counter.

Resistance: 2,600-2,700 Support: 2,100-2,000

The stock is continuously trading in an uptrend and has given a breakout above its horizontal trend line, which is placed at Rs 1,479 that indicates upside movement.

However, the stock has also given a breakout from its descending triangle formation and is now trading above this formation, which may see positive sentiment in the counter.

Resistance: 1,750-1,800 Support: 1440-1400

The stock has started to trade around its all-time high, as the momentum dynamics has shifted to a new zone.

The stock has reached its uncharted territory with ample volume activity, which indicates a favourable condition in which supply can get absorbed by fresh demand. Therefore, we can expect further upside movement.

Resistance: 1,750-1,800 Support: 1,360-1,300

The Pharma Index is not performing these days and it will take time to do so. Apollo Hosp reached its all-time high but the stock is very volatile, and the next resistance level is around Rs 1,550-1,600, and supports are placed at Rs 1,420-1,355.

A moment indicator RSI is also trading sideways, with a negative crossover, which shows that the near-term trend remains bearish.

The stock has been trading near support of its 21-day moving average on the daily chart, which suggest that the stock has a great potential.

Furthermore, the index has been formed a symmetrical triangle and is also trading above this formation which shows positive movement in the counter.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Get access to India's fastest growing financial subscriptions service Moneycontrol Pro for as little as Rs 599 for first year. Use the code "GETPRO". Moneycontrol Pro offers you all the information you need for wealth creation including actionable investment ideas, independent research and insights & analysis For more information, check out the Moneycontrol website or mobile app.

Bank mergers: Here is how the insurance JVs and policy holders will be impacted

In cases where one bank promotes two insurers in same category post merger, the companies will either have to be merged or sold

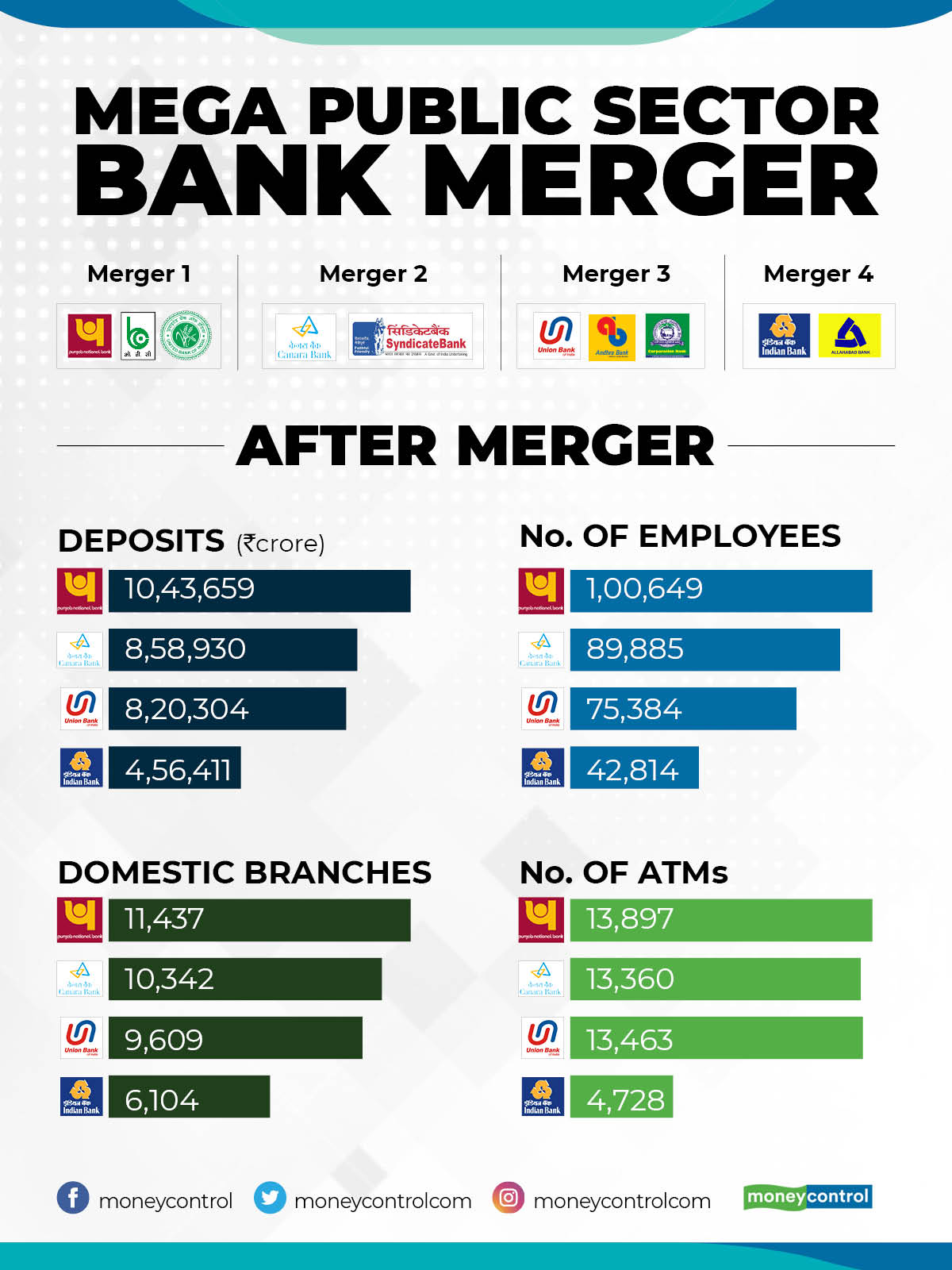

Finance Minister Nirmala Sitharaman on August 30 unveiled a mega merger plan for public sector banks (PSBs), amalgamating 10 banks into four. While the initiative is aimed at having fewer but stronger banks, this will impact the insurance joint ventures of the merger candidates.

Also, there may be some uncertainty for policyholders. Will their policy hold if the insurance provider is a part of a bank that is getting merged with another?

As per rules of the Insurance Regulatory and Development Authority of India (IRDAI), an entity or institution can promote only one insurance company in the life or non-life sector. Once the banks merge, some will have two life insurers within the group which is not permissible.

The candidates

The Oriental Bank of Commerce, along with United Bank, will be merged with Punjab National Bank. This raises questions on the future of OBC’s insurance entity Canara HSBC OBC Life Insurance. This is because PNB already has PNB MetLife Insurance and will not be allowed to hold stake in another life insurer.

Similarly, Andhra Bank (and Corporation Bank) will get merged into Union Bank of India. Union Bank has Star Union Dai-ichi Life Insurance while Andhra Bank has stake in IndiaFirst Life Insurance. Whereas Andhra Bank has planned to sell its stake in its insurance joint venture, the process has not yet been completed.

The consolidation will bring down the total number of public sector banks in the country to 12 from 27 in 2017. At the same time, this would also lead to a consolidation among insurance companies.

“It is clear that two life insurers will not be allowed to operate under one promoter. While an exception has been made for IDBI Federal Life which is owned by LIC-owned IDBI Bank, such relaxation will not be given for other entities,” said a senior official.

On the other hand, Canara Bank and Syndicate Bank are set to merge. Similarly, Allahabad Bank (JV partner in Universal Sompo) and Indian Bank will merge. However, these will not have any impact on the insurance JVs because the other party does not have any insurance venture.

Possible scenarios for customers

Policyholders may not have to worry. The regulator will ensure that, even if two entities merge, the policies remain intact. For instance, even if two life insurers were to be merged post bank consolidation, the features of the policies sold in the past would remain the same.

However, in case any of the banks is keen to sell off the stake and unable to find buyers, a period of uncertainty will follow. As per IRDAI rules, no joint venture partner can exit an insurance venture without finding an alternate buyer. But, since these are merger candidates, there is no clarity on the immediate steps that IRDAI will take.

“Players like Andhra Bank and Allahabad Bank have already expressed intent to exit/part sell their stake in the insurance business. Even if they are unable to find buyers, if the bank is merged, the legal status of the insurance venture will have to be immediately looked into,” said a Mumbai-based consultant looking at insurance M&A.

What can banks do?

If the existing shareholders are willing to buy out the outgoing bank’s stake, things will become easier. However, the foreign investment limit is also capped at 49 percent and, hence, stake purchase by the global shareholders is ruled out.

Another option for the banks is to immediately look for buyers. Consultants have said that several private equity firms are in the lookout to enter the insurance business. However, considering that the to-be-merged could be similar to a “distress” sale, the valuations offered may not be very attractive.

Since all the insurance companies have agreements between multiple joint venture partners, a majority of whom entered the business because of the presence of one another. If one bank exits, other shareholders may also decide to exit.

It is likely that a transition period will be provided, considering that several insurance ventures are concerned.

Meanwhile, the bancassurance agreements will also have to be re-visited. Each bank is allowed to sell three life, three non-life and three standalone health insurers’ products.

Once the merger is implemented, the past bancassurance (sale of insurance through banks) will not be valid and will have to be drafted afresh.Get access to India's fastest growing financial subscriptions service Moneycontrol Pro for as little as Rs 599 for first year. Use the code "GETPRO". Moneycontrol Pro offers you all the information you need for wealth creation including actionable investment ideas, independent research and insights & analysis For more information, check out the Moneycontrol website or mobile app.

TAGS #Business #Economy #Insurance

Board of Trade to meet on September 12 to discuss ways to boost exports

Issues about free trade agreements and ways to contain non-essential imports too would figure in the meeting, the official said.

The Board of Trade (BoT) will seek views of various stakeholders such as government departments, states, exporters and industry members on September 12 on ways to boost exports of goods and services, an official said. The high-level board, a top advisory body on external trade, is chaired by Commerce and Industry Minister Piyush Goyal.

Issues about free trade agreements and ways to contain non-essential imports too would figure in the meeting, the official said.

The government has merged the Council of Trade Development and Promotion with the Board of Trade to bring greater coherence in the consultation process with all stakeholders for promoting exports and imports.

The new board provides a platform to states and union territories for articulating their perspectives on trade policy and help states to develop and pursue export strategies in line with the national foreign trade policy.

Besides, the forum advises the government on policy measures for preparation and implementation of short and long term plans.

It would also review export performances of various sectors, identify constraints and suggest industry-specific measures to optimise export earnings and to examine existing institutional framework for imports and exports.

Its members include state ministers who are in charge of trade, secretaries of different departments like revenue, commerce, health and agriculture besides NITI Aayog CEO, Deputy Governor RBI, and CBIC chairman.

Presidents and chairpersons of industry chambers among others are ex-officio members.

The meeting assumes significance as shipments of some key sectors recorded negative growth in July. It included gems and jewellery (- 6.82 per cent), engineering goods (- 1.69 per cent) and petroleum products (- 5 per cent), according to the commerce ministry data.

During April-July 2019, exports dipped 0.37 per cent to USD 107.41 billion, while imports contracted by 3.63 per cent to USD 166.8 billion.Get access to India's fastest growing financial subscriptions service Moneycontrol Pro for as little as Rs 599 for first year. Use the code "GETPRO". Moneycontrol Pro offers you all the information you need for wealth creation including actionable investment ideas, independent research and insights & analysis For more information, check out the Moneycontrol website or mobile app.

India, Russia against 'outside influence' in internal matters of any nation: PM Modi

Modi, who arrived in Russia on a two-day visit during which he will also attend the Eastern Economic Forum (EEF), is the first Indian prime minister to visit to the Russian Far East Region.

India and Russia are against "outside influence" in the internal matters of any nation, Prime Minister Narendra Modi said after talks with Russian President Vladimir Putin on Wednesday during which they discussed ways to bolster cooperation in trade and investment, oil and gas, nuclear energy, defence, space and maritime connectivity.

Modi, who arrived in Russia on a two-day visit during which he will also attend the Eastern Economic Forum (EEF), is the first Indian prime minister to visit to the Russian Far East Region.

"We both are against outside influence in the internal matters of any nation," Modi said in a joint press meet with President Putin after their talks.

His remarks came against the backdrop of tension between India and Pakistan after New Delhi revoked Jammu and Kashmir's special status.

India has categorically told the international community that the scrapping of Article 370 of the Constitution was an internal matter and also advised Pakistan to accept the reality.

Russia has backed India's move on Jammu and Kashmir, saying that the changes in the status are within the framework of the Indian Constitution.

The two leaders held the delegation-level talks at the India-Russia 20th Annual Summit after a two-hour tete-a-tete on board a ship, aimed at strengthening the special and privileged relationship between the two sides.

They discussed ways to bolster cooperation in trade and investment, oil and gas, mining, nuclear energy, defence and security, air and maritime connectivity, transport infrastructure, hi-tech, outer space and people-to-people ties.

Prime Minister Modi said a proposal has been made to have a full fledged maritime route between Chennai and Vladivostok. A Memorandum of Intent was signed between India and Russia on the development of maritime communications between Chennai and Vladivostok.

"Due to the increasing localisation of nuclear plants being formed with the cooperation of Russia in India, we are also developing a true partnership in this field," he said.

"The India-Russia friendship is not restricted to their respective capital cities. We have put people at the core of this relationship," he added.

The Prime Minister said that Russia will help train Indian astronauts for the manned space mission -- the Gaganyaan project.

The two sides signed 15 agreements/MoUs in areas such as defence, air, and maritime connectivity, energy, natural gas, petroleum and trade.

"The friendship and support between both the countries is growing with full speed...Our special and privileged strategic partnership has not only benefitted our countries but also it has been used for the development of the people," Modi said.

"Both of us have taken our relationship to a new level based on cooperation and support which has resulted in not only quantitative changes but qualitative changes as well," Modi said.

On his part, Putin said India is one of the key partners of Russia and the relationship between the two states is of "strategic and special privileged nature".

"We placed our priorities on trade and investment cooperation last year. Our bilateral trade grew by almost 17 per cent and mounted to USD 11 billion. There is every condition that it will grow further up," he said.

He said it common goal of the two sides to reach an agreement to establish a free trade area between India and the Eurasian economic union.

Noting that Russia is a reliable source of energy supplier to India, Putin said, "Last year we have shipped 3.3 million tonnes of oil to India, almost 550 thousands tons of oil products and 4.5 million tones of coal.

He said the flagship joint project is the cooperation in the Kudankulam Nuclear Power Plant. "The first two units are already operational. The work for the third and fourth unit are going as per schedule," he said.

Underlining the cooperation between India and Russia in technical and military areas, Putin said, "We are successfully implementing our bilateral programme on military and technical cooperation up to 2020. We are working to update it to extend to another 10 years."

Earlier in his opening remarks at the summit held on the sidelines of the EEF, which Russia has hosted since 2015 to boost partnerships with Asian countries, Modi said Russia is an "integral friend and trustworthy partner" of India as he praised President Putin's personal efforts on expanding the special and privileged strategic partnership between the two countries.

Modi expressed his gratitude to President Putin and people of Russia for conferring Russia's highest civilian award on him. "This demonstrates the friendly relations between the people of our two countries. It's a matter of honour for the 1.3 billion Indians," he said.

Prime Minister Modi was named for the 'Order of St Andrew the Apostle' award by Russia in April for his exceptional services in promoting bilateral ties between the two countries. The award is the highest state decoration of Russia.Get access to India's fastest growing financial subscriptions service Moneycontrol Pro for as little as Rs 599 for first year. Use the code "GETPRO". Moneycontrol Pro offers you all the information you need for wealth creation including actionable investment ideas, independent research and insights & analysis For more information, check out the Moneycontrol website or mobile app.

TAGS #Current Affairs #India

Making money in equity markets is not easy and it gets doubly difficult when there is a fear of recession. India's growth is at a six-year low and it sent the Sensex and the Nifty hurtling below crucial support levels on September 3.

But, some stocks, including HDFC AMC, Asian Paints, Apollo Hosp and Dr Lal Pathlab, have braved the gloom to consistently hit fresh 52-week highs.

On September 3, too, more than 30 companies hit new highs on the BSE, when the Sensex was down nearly 800 points and Nifty more than 200. Abbott India, Bata India, HDFC AMC, ICICI Lombard, InterGlobe Aviation, Infosys, Petronet LNG and TCS were among the stocks that did well.

So, should one invest in these stocks? Or is the TINA (there is no alternative) factor playing out in favour of some of the stocks? Does it make sense to play the momentum?

The answer lies in appetite for risk, says experts. The fact that most of these stocks have been rallying for some time, the risk-to-reward ratio might not be that attractive.

“TINA along with passive strategies is one of the reasons we are seeing this concentration in the market. So yes, there is a TINA effect since even if there is a stock that is attractive as per valuations in small or midcap with a good growth story, we are not seeing buying coming in,” Mustafa Nadeem, CEO, Epic Research, told Moneycontrol.

“Hence the smallcap and midcap are paying the prices for the same. So, momentum may continue due to TINA or FOMO but it is not necessary they may continue to lead. One has to be cautious,” he said.

But, some stocks do have a good fundamental story and investors can buy them on dips for a long-term perspective, as most of them are leaders in their segments. However, if you are invested then partial profit booking could be done on rallies.

HDFC AMC is one of the best performing life insurance companies posting better AUM for the quarter, while Bata India posted margin led growth.

Dr. Lal Pathlabs reported strong volume performance for the June quarter and is expected to post higher volume and profitability led growth in FY20.

Apollo hospitals, apart from delivering a strong quarter, has guided for debt reduction and stated that it is likely to reduce promoter pledge. Asian Paints and Berger both posted strong revenue and profits (due to lower crude oil prices).

“It wouldn't be fair to say that TINA factor is playing in some of these stocks, as despite hovering at 52-week highs, most of the companies are leaders in their respective sectors. They have been consistent performers and have good long-term growth prospects going ahead,” Ajit Mishra, Vice President, Religare Broking, told Moneycontrol.

“Nevertheless, we would advise investors to book partial profit, as there might be some consolidation in the near-term given stretched valuations.”

Sumeet Bagadia, Executive Director, Choice Broking, gives a technical outlook on HDFC AMC, Asian Paints, Bata India, Apollo Hospitals and Dr. Lal Pathlabs, which hit a fresh 52-week high in the week gone by:

The stock has performed well in the last one year after listing. The stock is trading above its 21 and 500-days simple moving averages, which show that there is more upside.

On the weekly chart, the stock has been trading in its upward rising wedge formation and is hovering near the breakout zone.

The RSI reading is at 72.43 level and gives positive crossover, apart from this, the RSI has formed symmetrical triangle and also trading above this formation, which points out a positive breath in the counter.

Resistance: 2,600-2,700 Support: 2,100-2,000

The stock is continuously trading in an uptrend and has given a breakout above its horizontal trend line, which is placed at Rs 1,479 that indicates upside movement.

However, the stock has also given a breakout from its descending triangle formation and is now trading above this formation, which may see positive sentiment in the counter.

Resistance: 1,750-1,800 Support: 1440-1400

The stock has started to trade around its all-time high, as the momentum dynamics has shifted to a new zone.

The stock has reached its uncharted territory with ample volume activity, which indicates a favourable condition in which supply can get absorbed by fresh demand. Therefore, we can expect further upside movement.

Resistance: 1,750-1,800 Support: 1,360-1,300

The Pharma Index is not performing these days and it will take time to do so. Apollo Hosp reached its all-time high but the stock is very volatile, and the next resistance level is around Rs 1,550-1,600, and supports are placed at Rs 1,420-1,355.

A moment indicator RSI is also trading sideways, with a negative crossover, which shows that the near-term trend remains bearish.

The stock has been trading near support of its 21-day moving average on the daily chart, which suggest that the stock has a great potential.

Furthermore, the index has been formed a symmetrical triangle and is also trading above this formation which shows positive movement in the counter

Good information

ReplyDeleteBharat Bond ETF

Bharti Airtel

Bharat Sanchar Nigam Ltd

ESAF Microfinance

Nice informatiom. Thanks for sharing. You may also check latest updates on Stocks like

ReplyDeleteNirmala Sitharaman about Financial Package

52-week low on NSE

ABB India Q1 results

Bharti Infratel

Good Article. Thanks for sharing such greatful information.

ReplyDeletestocks in the news

V Guard

Kotak Mahindra Bank

Interglobe Aviation

Hey...Great information thanks for sharing such a valuable information

ReplyDeletePetronet LNG shares

Hindalco Industries Ltd

Adani Ports and Special Economic Zone Ltd

Housing Development Finance Corp Ltd

The great thing about this post is quality information. I always like to read amazingly useful and quality content. Your article is amazing, thank you for sharing this article.

ReplyDeleteForex Trading

Forex Market

Foreign Exchange Market

PERDE MODELLERİ

ReplyDeletesms onay

mobil ödeme bozdurma

NFT NASIL ALİNİR

Ankara evden eve nakliyat

Trafik sigortasi

DEDEKTÖR

WEB SİTE KURMA

ASK KİTAPLARİ

smm panel

ReplyDeleteSmm Panel

is ilanlari blog

İnstagram Takipçi Satın Al

https://www.hirdavatciburada.com

beyazesyateknikservisi.com.tr

servis

tiktok jeton hilesi

tuzla vestel klima servisi

ReplyDeleteataşehir samsung klima servisi

çekmeköy mitsubishi klima servisi

ataşehir mitsubishi klima servisi

çekmeköy alarko carrier klima servisi

ataşehir alarko carrier klima servisi

çekmeköy daikin klima servisi

ataşehir daikin klima servisi

maltepe toshiba klima servisi